The Growth and Development of Eden Farm Ltd

Submitting Institution

University of DurhamUnit of Assessment

Business and Management StudiesSummary Impact Type

EconomicResearch Subject Area(s)

Commerce, Management, Tourism and Services: Accounting, Auditing and Accountability, Business and Management

Summary of the impact

Eden Farm Ltd (a medium-sized company that produces frozen foods in the

north east of England) approached Durham University Business School (DUBS)

to work together from 2005. The impact of this collaboration was that DUBS

research provided the company with (i) a changed approach to the

management of resources, resulting in improved service delivery; (ii) the

development of new and improved work processes; (iii) improved

effectiveness in workplace practices; and (iv) better access to financial

opportunities. Indeed, turnover and profitability increased well ahead of

the sector average between 2008 and 2012 — growth that the company

attribute to improvements from the application of DUBS research.

Underpinning research

DUBS has a longstanding research strength in methods for developing

strategic management accounting as a tool to gain strategic advantage.

Reference 1 was one of the first research papers to outline thinking on

this issue, defining strategic management accounting as follows: "[t]he

provision and analysis of information relating to a firm's internal

activities, those of its competitors and current and future market trends,

in order to assist in the strategy evaluation process" (p.605). It went on

to elaborate the argument that the adoption of strategic management

accounting would involve management accountants undertaking the following

new tasks: "strategic business unit identification; strategic cost

analysis; strategic market analysis; [and] strategy evaluation" (p.607).

The fusion of the management accounting and strategist roles was

particularly innovative at the time. This is because the prevailing wisdom

held that it was the strategist who needed to be outward-looking — with

the management accountant, in contrast, needing to take a relatively

introspective view of the business.

Reference 1 made its arguments conceptually. However, Reference 2 built

on these claims to show from empirical evidence the benefits (and the

limitations) of the proposition that "management accounting and strategy

are inextricably linked" (p.273). Reference 2 detailed four contributions

that strategic management accounting could make to companies in gaining

competitive advantage: (i) achieving "balance [amongst] functional, area

and product perspectives" (p.274); (ii) coordinating "interaction across

business units using formal systems" (p.274); (iii) "competitor analysis

... [including in particular] a need for greater attention to be given to

emerging threats in proximate markets" (p.274); and (iv) "a more

integrated approach to resource allocation" (p.274). This research then

illustrated and examined "the practicality of strategic management

accounting in a dynamic setting" (p.274) via a case study of one

particular company (a small-to-medium sized company located in the north

west of England) "that displayed characteristics of using the concepts

associated with strategic management accounting" (p.274). The case study

showed, in particular, the key role played by linking management

information and accounting systems with strategy formulation and an

awareness of the external environment. However, it also demonstrated the

limitations of strategic management accounting, in that, at the time of

writing, the costs of "the information demands placed upon an organisation

by strategic management accounting may outweigh the benefits" (p.279) in

some cases. Nevertheless, the research concluded by reflecting that:

"[t]he concept of strategic management accounting has to be developed by

both practitioners and academics. With greater interaction between the two

groups, strategic management accounting can be developed beyond its

current state, and the concept may achieve more widespread application and

help organisations to enhance their competitive advantages in intensely

competitive markets" (p.279).

It is in the light of this last comment that the work detailed in the

case study should be understood. The research which had an impact upon the

strategic financial systems of Eden Farm Ltd meant that the lead

researcher interacted with practitioners so that they benefited from the

strategic management accounting approach set out in DUBS research.

Dixon joined DUBS in 1992 and is still a member of faculty; Smith was a

graduate student at DUBS who went on to be appointed as an academic member

of staff in 1995.

References to the research

Details of the impact

In 2005, Eden Farm Ltd approached DUBS (along with the Durham Engineering

Department who recommended various measures for business reengineering in

parallel research) as an Associate in the Knowledge Transfer Partnerships

(KTP) Scheme run by Durham University. In its KTP Grant Application and

Proposal Form (Evidence 1), the company stated: "Eden Farm lacks an

understanding of current thinking, best practice and methodologies which

lead to difficulties in applying modern tools and techniques within the

operations and finance aspects of the business. The opportunity in finance

[i.e. directly relevant to this DUBS case study] is to undertake detailed

analyses including cost base analysis, product analysis, customer analysis

and distribution route analysis to create an advanced financial model to

underpin the strategic finance plan for the future of the organisation"

(p.2/3). DUBS stated in the same document that it undertook to "work on

introducing [for Eden Farm] new systems for multi-layered financial

modelling and strategic financial planning through:

- Understanding the cost base

- Creating a coherent data set for Eden Farm to allow analysis and

tracking of the cost base relating to

- supplier, product and stock keeping unit

- customer performance

- distribution

- Developing a methodology for creating, and introducing, a

multi-layered Financial Modelling and Scenario Planning to meet the need

of this complex business.

- Introducing Strategic Financial Planning techniques and developing a

Strategic Financial Plan to underpin long term investment decisions in

the company, documenting processes and training finance staff and

management to use the modelling and strategic financial planning

processes" (p.3).

DUBS also undertook to provide Eden Farm with "[r]obust financial

analysis systems and coherent data set creation along with regular

tracking and monitoring of the cost base [that] will provide

- Improved management information and a basis for negotiation with

suppliers and customers.

- The ability to price goods more accurately and thereby raise margins

- Maximise bonus and discount payments from suppliers by optimising

minimum order levels and sales volumes

- Development and implementation of the multi-layered financial model

will support Scenario Planning to underpin risk assessment in a highly

competitive market

- Strategic financial planning will underpin major financial decision

making such as investments in new premises and staff development in the

medium to long term.

- Key staff trained on use of the financial analysis, modelling and

strategic planning techniques (p.3)

This research-based consultancy was conducted between March 2006 and

March 2008, and used the principles set out in Reference 1 and 2. For

example, Eden Farm implemented a system of strategic cost analysis, which,

following reference 2 is: "important as it allow[s] a greater level of

understanding of the behaviour of direct and indirect costs" (p.277) The

final KTP report (Evidence 2) produced in March 2008, allowed Eden Farm

Ltd to implement fully the recommendations. Indeed, in evidence 2, the

company stated (on a scale of high to nil) that the significance of the

results of the KTP to the company's present and future performance were

both "high" (Evidence 2, p.6). And in terms of the impact of the

specifically accountancy research (as opposed to the reengineering

research) on the operation of the company, Eden Farm stated that they had

changed their approach to the management of resources: "[t]he procedures

and controls implemented within the areas of stock pricing, promotions and

claims have successfully been transferred to two new members of staff.

Advanced use of Excel has been introduced into the company which has

enhanced reporting and use of data to support decision making. Deeper

understanding of pricing structures has enabled the company to win and

retain larger accounts through offering promotions to key accounts, as

well as getting the price right first time.... the enhanced IT systems

have improved accounting processes which are now in use on a daily basis"

(Evidence 2, p.3). Hence, from early 2008, DUBS research had an impact by

also developing and improving Eden Farm Ltd's work process and workplace

practices.

In terms of better access to financial opportunities, in the final KTP

report, Eden Farm also stated that additional pre-tax profits (i.e. those

which have been affected by the improvements resulting from the KTP) were

expected to total £500K by the end of 2008. The company also predicted

increased profits over the next 3 years of £1,500K as a direct result of

the KTP project. Indeed, the company also stated that the "long term

strategy for Eden Farm is to increase turnover to £30m by 2010. This is

equivalent to a 20% growth year on year. The improvements and

recommendations resulting from the KTP will allow this target to be

achieved" (p.5; our italics). Such predictions are broadly in line

with actual results. In information available from Companies House (see

evidence 3) the following changes are recorded:

Table 1: Eden Farm Turnover and Profits

| Date of Accounts |

2011 |

2010 |

2009 |

2008 |

| Turnover (‘000 GBP) |

38,344 |

32,567 |

26,618 |

22,295 |

| Gross profit (‘000 GBP) |

6,540 |

5,287 |

4,922 |

4,131 |

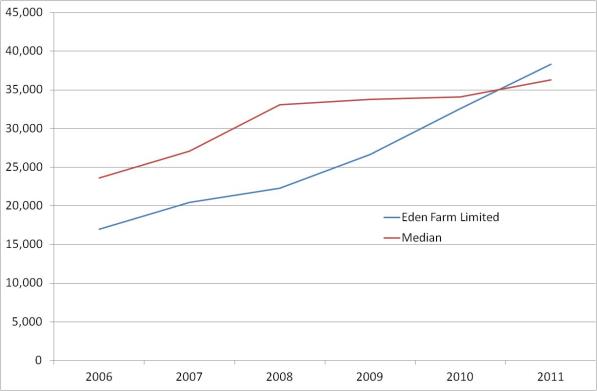

As Figure 1 shows, a significantly steeper, upwards turnover-gradient

started for Eden Farm from 2008 (i.e. at the end of the DUBS research

project). It also shows that this rise was not mirrored in trends

within the sector (where turnover flat-lined during the same period). A

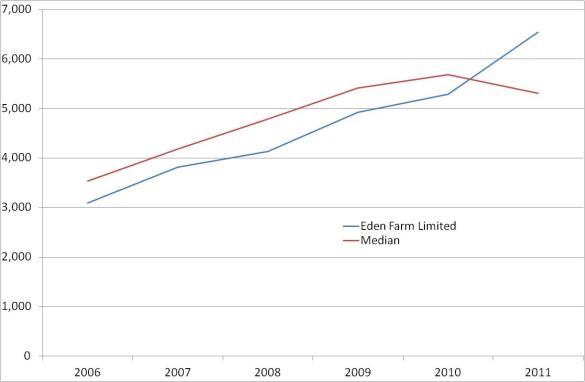

similar trend can be seen in Figure 2 in respect of gross profit. Eden

Farm's results were all the more impressive given that the North East of

England was the region hardest hit by the economic downturn that started

in 2008.

Figure 1: Turnover (`000 GBP) — Eden Farm and median of comparison

group, 2006-11

Figure 2: Gross profit (`000 GBP) — Eden Farm and median of comparison

group, 2006-11

Furthermore, Eden Farm's CEO states in a testimonial written for this

case study:

"The Knowledge Transfer Programme run with Durham University from

2006-2008 had a major positive impact on the performance of Eden Farm Ltd.

This was not only in terms of growth — Eden Farm has been in the Ward

Hadaway Journal Fastest 50 Growth Companies* for three consecutive years

following the KTP ... but also through a turn around in company

profitability. ... New processes and procedures were introduced ... as a

consequence to improve our performance. These met with considerable

success

- Improved management information;

- Better understanding of current thinking and best practice

methodologies ...

We are very grateful to Durham University for this platform building work

and the ongoing dialogue and support [Dixon has met the CEO annually since

2008 to provide advice on the company's finances, accounting systems and

strategy] since then."

*A league table of companies in the North East of England produced by law

firm Ward Hadaway; see evidence 4 for the announcement of the 2010 award

in The Journal, Wednesday October 13th 2010 — the third

year that Eden Farm featured.

Taken together, the data in Figures 1 and 2, along with Eden Farm's

specific predictions (in the KTP final report) and its current analysis

(in the testimonial), suggest that the DUBS research which introduced

strategic cost analysis and improved accounting and other practices was

also highly likely to have had a secondary impact from 2008 — i.e. it also

increased Eden Farm's turnover and profits. In both basic measures —

turnover and gross profit — not only has Eden Farm experienced an increase

in absolute terms, but also in its rank among the comparison group. In

each case, during the REF period, Eden Farm has improved from below to

above the median — i.e. from the bottom 50% to the top 50%. (The detailed

data, the sources from which it was obtained and the methods used in

constructing the comparison groups are detailed in Evidence 3).

Furthermore, the student who worked with Dixon on the KTP featured in the

KTP awards for 2008 because he "has had an instrumental role in

establishing profitable avenues, and adapting to new challenges for the

company" (Evidence 5).

In summary, the impact of DUBS research has been very significant for

Eden Farm Ltd. It led directly to the company developing and improving the

effectiveness of many of its working practices. These improved practices

are very likely also to have had a secondary impact — a sector-beating

increase in turnover and gross profit. Furthermore, the case study also

demonstrates the potential relevance of DUBS research for the future

development of management accounting and other financial systems in other

contexts. Companies similar to Eden Farm — of which there are many

hundreds in the UK alone — may well be able to benefit in the same sorts

of ways, suggesting the potential reach of future projects based on

similar underpinning research is substantial.

Sources to corroborate the impact

Evidence

- Knowledge Transfer Partnerships Grant Application and Proposal Form

(Eden Farm)

- Knowledge Transfer Partnerships Final Report (Eden Farm)

- Report on Eden Farm from Paul Braidford, Senior Research Fellow

(Policy Research Group) of St. Chad's College.

- The Journal, Wednesday 13th October 2010 "The fastest 50

growing companies in the region 2010"

- KTP Awards 2008.

Testimonial

- Eden Farm CEO.