Policy Advocacy for Economies in Deep Recessions

Submitting Institution

University of St AndrewsUnit of Assessment

Economics and EconometricsSummary Impact Type

EconomicResearch Subject Area(s)

Economics: Economic Theory, Applied Economics, Econometrics

Summary of the impact

The world financial crisis and recession of 2007-

2009, and the continued stagnation of global

economies, has raised the question of how

governments and central banks should respond

in deep recessions. Prof. Evans and colleagues

have shown using macroeconomic models with

adaptive learning that after large pessimistic

shocks, a rapid switch to aggressive monetary

easing is required and aggressive fiscal policy

may be needed. To achieve policy impact this

work has been presented in numerous central

bank conferences, and it has caught the

attention of several members of the US Federal

Reserve Open Market Committee (FOMC). The

policies of the FOMC since 2008 have been consistently aggressive, despite

public criticism and

even dissension within the FOMC itself. This research has provided

important academic support

for the application of these policies.

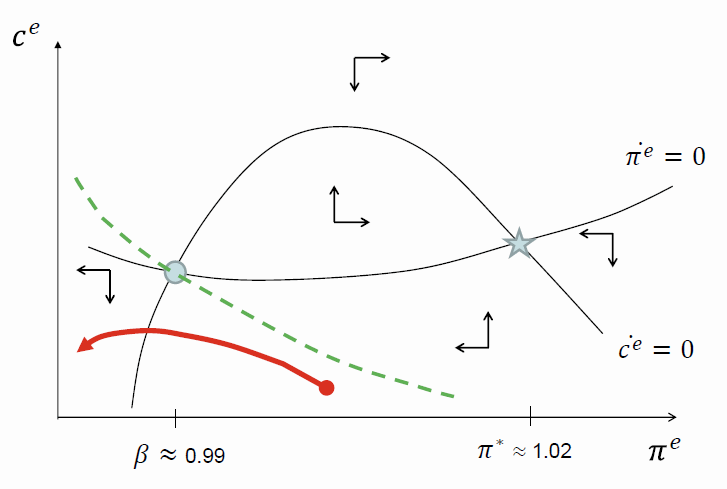

Divergent paths can result from large

negative expectation shocks.

Divergent paths can result from large

negative expectation shocks.

Underpinning research

In "Liquidity Traps, Learning and Stagnation" (EGH2008)1

Evans, Guse and Honkapohja consider

a standard New Keynesian model with the interest-rate rule subject to a

zero lower bound. The

previous literature focussed on model solutions under the "rational

expectations" (RE) hypothesis.

In contrast to this literature, and applying recently developed adaptive

learning techniques,

EGH2008 replaced RE with the assumption that agents (households and firms)

forecast future

output and inflation using simple statistical adaptive learning rules.

Such learning rules are

boundedly rational, but they are arguably a more realistic way to model

expectations.

EGH2008 shows that the potential for deep recession is much greater in

models with learning:

while the intended equilibrium is locally stable under learning, unstable

deflationary paths can arise

after large pessimistic shocks to expectations, including trajectories

with falling aggregate output.

EGH2008 demonstrates that aggressive monetary and fiscal policy is

necessary when the

economy has been hit by a large pessimistic shock. A 2008 companion paper2,

written following an

earlier visit by Prof. Evans to the Bank of Japan, provides additional

discussion. The results of

EGH2008 were disseminated widely in a 2009 Annual Reviews article.3

Three subsequent papers extended this research. "Expectations, Deflation

Traps and

Macroeconomic Policy"4 and "Liquidity Traps and Expectation

Dynamics: Fiscal Stimulus or Fiscal

Austerity?"6 incorporate long-horizon forecasts by households

and firms and non-Ricardian wealth

dynamics. "The Stagnation Regime of the New Keynesian Model and Recent US

Policy" (2013)5

shows that convergence to a locally stable stagnation regime can also

result from large negative

expectation shocks. This paper examines practical policy implications in

detail. It is shown that

sufficiently large temporary increases in government spending can dislodge

the economy from the

stagnation regime and restore the natural stabilizing dynamics. Other

policy proposals, including

quantitative easing, are discussed, as well as how nations and US States

can manage debt levels

to ensure fiscal flexibility in these settings.

In separate but related work, "Learning about Risk and Return: A simple

model of bubbles and

crashes" (2011)7, Branch and Evans study the propensity of

asset price bubbles and crashes to

emerge when traders use adaptive learning rules to forecast both risk and

returns. An asset price

crash, like the one in 2007-9 following the collapse of the housing price

bubble, can be a trigger for

a large pessimistic expectation shock with the potential for deep

recession.

In summary, the underpinning research on expectations and adaptive

learning in deep recessions

following large negative shocks has strong policy implications: (1) The

most serious danger is a

disequilibrium deflation trap in which deflation increases real interest

rates, leading to lower

aggregate output, which worsens deflation. (2) To avoid this trap monetary

policy, in response to a

large pessimistic shock, should quickly and aggressively reduce interest

rates to near zero. (3)

Fiscal policy, taking the form of a short-term fiscal stimulus is a

complementary policy that may

also be necessary. Austerity is usually ineffective. (4) If a sufficiently

large fiscal stimulus is

politically impossible, then less conventional monetary stimulus should be

used.

Key researchers:

George W. Evans. Since October 2007, SIRE Professor of Economics and

Finance, University of

St. Andrews, UK and John B. Hamacher Professor of Economics, University of

Oregon, Oregon,

USA.

Seppo Honkapohja. 2004-2008, Professor of International Economics,

University of Cambridge,

Cambridge, UK. Since 2008, Member of the Governing Board, Bank of Finland.

References to the research

1. "Liquidity Traps, Learning and Stagnation," (George W. Evans, Eran

Guse and Seppo

Honkapohja), European Economic Review, Vol. 52, 2008, 1438 - 1463.

DOI:

10.1016/j.euroecorev.2008.05.003

(EGH2008).

[EER is a peer reviewed and highly regarded international general

interest journal.]

3. "Learning and Macroeconomics," (George W. Evans and Seppo Honkapohja),

Annual Review of

Economics, Vol. 1, 2009, 421-449. DOI: 10.1146/annurev.economics.050708.142927

[Annual Reviews is a widely cited critical review series for a

broad spectrum of sciences. This

article, which includes a summary of the research in the EER paper

(reference 1), was chosen to

be included in the first volume published in Economics.]

4. "Expectations, Deflation Traps and Macroeconomic Policy" (George W.

Evans and Seppo

Honkapohja), Ch. 11 in Twenty Years of Inflation Targeting: Lessons

Learned and Future

Prospects, ed. D Cobham, Ø Eitrheim, S Gerlach & J Qvigstad,

Cambridge University Press,

2010SBN: 9780511779770, DOI: 10.1017/CBO9780511779770.011

5. "The Stagnation Regime of the New Keynesian Model and Recent US

Policy" (George W.

Evans), Ch. 3 in Macroeconomics at the Service of Public Policy,

eds. T.J. Sargent and J.

Vilmunen, Oxford University Press, 2013.The first draft was written &

disseminated in Oct. 2010.

DOI: 10.1093/acprof:oso/9780199666126.003.0004

[Monographs 4 and 5 were published by world-leading academic publishing

establishments.]

7. "Learning about Risk and Return: A Simple Model of Bubbles and

Crashes" (William Branch and

George W. Evans), American Economic Journal: Macroeconomics, Vol.

3, 2011, 159-191. DOI:

10.1257/mac.3.3.159

[This is one of the top international peer-reviewed macroeconomics

journals.]

Details of the impact

The impact of this case study was to influence public discourse and to

provoke discussion with

policymakers, economists and the general public about the need for

aggressive monetary easing

and fiscal stimulus in the wake of the financial crisis and recession of

2007-9. This is a significant

contribution to a major contemporary issue. The impact took the form of

policy-oriented papers

presented at conferences attended by top monetary policymakers,

dissemination of the research in

a widely read economics blog, and contact with Federal Reserve Bank

presidents and members of

the Federal Reserve Open Market Committee (FOMC).

There is a severe limit on the extent to which specific impact on Central

Bank policy can be

documented. Central banks rarely cite factors other than economic

conditions when announcing

policy changes. Evidence of impact is therefore largely indirect: speeches

by top policymakers,

seminars and conferences arranged or attended by them, and the actual

course of policy. First,

there has been considerable interest within central banks in the adaptive

learning approach to

expectations, used in the underpinning research, and its implications for

policy. For example, Prof.

Evans co-organized the 2008 "Learning week" workshop at the FRB (Federal

Reserve Bank) St.

Louis, gave a keynote talk at the July 2012 FRB St. Louis Conference on

"Expectations in Dynamic

Macroeconomic Models" and was a visiting scholar during 2008-9 at FRBs St

Louis and Cleveland.

The Bank of Japan commissioned a 2008 article by him on policy in deep

recessions for their

journal Monetary and Economic Studies. Two regional FRB Presidents

have done important

research using the adaptive learning approach, have supported FRB

workshops and conferences

on its implications for policy, and have been keynote speakers at these

conferences. [S5].

The underpinning research, and its implications for policy, has been

disseminated to the public,

economists and policymakers in a number of ways. For the economics

profession, the results have

been summarized in published survey papers. For the general public an

opinion piece was written

for a newspaper

and made available through the Economist's

View, a widely read economics blog

that aims for dissemination of recent papers, opinion and discussion in

economics. [S6]. The

Economist's View also discussed and disseminated key parts of the

research of this case study

[S7, S8, S9], including the first

draft of the Stagnation Regime paper. [Ref. 5].

For research economists and central bank policymakers, a major channel

for dissemination and

advocacy has been presentation of the research of this case study in

Conferences at which senior

policymakers were present, including at the Norges Bank (2009), IMF, Wash

DC (2009), Swiss

National Bank (2009), Erasmus University (2010), Université de la

Méditerranée, Marseille (2011)

and the Federal Reserve Bank of St. Louis (2012). [S5]. In addition to

central bank economists,

each conference was attended by one or more senior policymakers: Governor

and Deputy

Governor, Norges Bank; the IMF Chief Economist; Governor, Central Bank of

Cyprus; Deputy

Governor, Sveriges Riksbank; and the Presidents of the Federal Reserve

Banks of San Francisco,

St Louis and Minnesota. These people are influential or directly

participate in setting monetary

policy. In addition, Prof. Evans's long-term co-author Seppo Honkapohja is

a Member of the

Governing Board of the Bank of Finland, which participates in ECB policy.

There have been several specific interactions with US monetary

policymakers. The FOMC, which

sets monetary policy, has followed an aggressive expansionary monetary

policy throughout the

financial crisis and its aftermath, continuing to this day. This policy

has been more consistently

aggressive than in other countries. However, members of the FOMC have had

a range of views

about policy, and FOMC votes have not always been unanimous. The policy

debate was intense in

early 2009 and again in the summer and autumn 2010. The research of this

case study provided

support for the policies that were followed. As noted below, several

members of the FOMC were

aware of this research, which provided strong reasons for following

aggressive policies, and which

supported the positions of the Chairman and the majority and against the

position of dissenters.

More specifically, in late 2008, Prof. Evans sent [text removed for

publication] a copy of EGH2008,

and received a reply thanking him for the paper and commenting on its

relevance in the current

circumstances. [S3]. In March 2009, the authors of EGH2008 were told by a

Federal Reserve

Board economist that he would be presenting their "very nice" paper to

[text removed for

publication]. They were told afterward that the presentation had gone

smoothly and that it was

"good advertising" for their paper and research. [S4].

In the summer of 2010, the President of the FRB, St Louis, who was viewed

at the time as a

centrist, published a paper "Seven

Faces of `The Peril'" which discussed the possibility that the US

might become enmeshed in Japanese-style deflation. (The paper included

references to the

research of this case study). [S8]. In this paper and in the months

thereafter, this President

recommended that low interest rate policies be supplemented by

"quantitative easing" (QE2). In

September 2010, Prof. Evans wrote and first presented the "stagnation

regime" paper, extending

the earlier model and providing additional support for aggressive monetary

and fiscal policies. Thispolicy-oriented

paper was disseminated and discussed on the blog Economist's Views.

[S9].

In his [text removed for publication] 2010 speech, [text removed for

publication] suggested that

interest rates might need to be increased to avoid deflation. On

August 31, the President of FRB

St Louis, in commenting on a post on the Fedwatch

blog, mentioned that Prof. Evans is "one of the

world's experts on the question of the dynamics" lying behind the

Figure that he used in his Seven

Faces paper. [S8]. Noting this, Prof. Mark Thoma [S2] asked Prof. Evans to

make a video

explaining why adaptive learning theory implies that increasing interest

rates is the wrong policy

when deflation threatens. This

video was posted on Economists' View on Sept. 1, 2010. [S7].

According to Prof. Thoma, the video has had over 9,600 views. [text

removed for publication]

[S10]. [text removed for publication]

The policies of the FOMC have been in line with those recommended in the

research of this case

study. Aggressive monetary policy has been followed, and the Chairman has

been explicit

concerning the danger posed by deflation [S11(i)], a central focus of this

research. The Chairman

has also consistently stated that, in the context of longer-run plans for

fiscal stability, short-term

fiscal stimulus and deficit spending is desirable to support the economy.

[S11(ii)]. The policy of

Quantitative Easing can be viewed as a response to inadequate fiscal

stimulus. These policies

have been highly controversial. While the Chairman and the majority of the

FOMC had many

reasons for pursuing the policy they followed, the research of this case

study will have been helpful

in providing support for their stance.

Sources to corroborate the impact

S1. Corroborating contact: Dr. Seppo Honkapohja, Bank of Finland. [text

removed for publication]

S2. Corroborating contact: Professor Mark Thoma, Economics Department,

University of Oregon.

[text removed for publication]

S3. [text removed for publication]

S4. [text removed for publication]

S5. Conference presentations (with hyperlinks): (i) Norges Bank

Conference 2009 InflationTargeting

Twenty Years On (ii) IMF Conference: Macroeconomic

and Policy Challenges FollowingFinancial Meltdowns, 2009. (iii)

Swiss National Bank, 2009 Financial

Markets, Liquidity andMonetary Policy (iv) Erasmus University

Conference 2010, Expectations,

Asset Bubbles andFinancial Crises. (v) Université de la Méditerranée

& GREQAM-IDEP, Marseille, 2011. AssetPrices,

Credit and Macroeconomic Policies, (vi) FRB St Louis Conference,

2012, Expectations

inDynamic Macroeconomic Models. Corroborate both the conference

presentations of the research

of the case study and the presence at those conferences of senior

policymakers.

S6. Newspaper commentary, 2009: fiscal

policy in deep recessions & Economist's View synopsis.

Corroborates that the underpinning research, and its implications for

policy, has been disseminated

to the public, economists and policymakers.

S7. Sept. 2010 Economist's View blog with Prof.

Evans's video discussion of interest rate policy,

"The Dynamic Properties of New Keynesian Models with Learning".

S8. FRB St. Louis President's 2010 paper "Seven

Faces of the Peril", which cites Prof. Evans's

research papers, and his 31/8/2010 comments

on Prof. Evans reported in Economist's View.

S9. Oct. 2010 Economist's View synopsis

of Stagnation Regime draft. Later Oct. 2012 discussionon

Fed Watch blog. Economist's View synopsis

of Reference 6 paper and Forbes.com synopsis.

Corroborates that the underpinning research, and its implications for

policy, has been disseminated

to the public, economists and policymakers.

S10. [text removed for publication]

S11. Speeches by Federal Reserve Board Chairman (i) emphasizing dangers

of deflation 27/8/10

and 17/7/12,

(ii) short-term fiscal support 21/7/10,

12/5/11,

20/11/12.