Scancell - a successful cancer immunotherapy company

Submitting Institution

University of NottinghamUnit of Assessment

Clinical MedicineSummary Impact Type

TechnologicalResearch Subject Area(s)

Medical and Health Sciences: Immunology, Oncology and Carcinogenesis

Summary of the impact

The University of Nottingham spin out company Scancell Holdings plc is

developing novel immunotherapies for the treatment of cancer. By licensing

products (£6million) and listing and raising money (£4million) on the

stock exchange, it has provided an excellent return for investors. In

2012, in response to good clinical trial results, Scancell's shares showed

the greatest percentage increase (10fold) on London's AIM stock exchange,

reaching a market capitalisation of £98million. This has encouraged

further investment (£6.5million) which is in line with the Government's

plan to promote the Biotechnology Industry. As the products progress to

market it will save further lives and continue to increase in value

providing further profit for investors.

Underpinning research

Cancer is the second leading cause of death in the Western world.

Worldwide, around 12.7 million cancer cases are diagnosed every year, and

this is expected to increase to 21 million by 2030. The drive behind the

Cancer Immunotherapy group at The University of Nottingham (UoN) was

therefore to improve treatment for cancer patients worldwide. In order to

fund the development of these products, Professor Lindy Durrant (Professor

of Cancer Immunotherapy, UoN, 2003-2013) spun out Scancell and, in 2008,

listed on the Plus and then AIM London stock market. Durrant is the joint

CEO of Scancell.

Durrant developed both novel oncolytic monoclonal antibodies (mabs) which

recognised unique glycolipids, and pioneered novel cancer vaccines

targeting dendritic cells in vivo. All of these immunotherapies

were licensed to Scancell. The company prioritised three mabs — SC100,

SC101 and SC104 — for further development and patenting. SC100 recognised

epidermal growth factor receptor and inhibited binding of its growth

factor, resulting in significant inhibition of tumour growth. SC101

recognises a glycan, Lewis y-b, and shows direct tumour

killing. SC104 showed good in vivo anti-tumour responses,

recognised a unique glycolipid antigen sialyltetraosylceramide and

mediated apoptosis (1). In collaboration with Peptech/Kyowa Hakko Kirin,

SC104 was therefore humanised, defucosylated and further patent protected.

SC104 subsequently entered Phase I clinical trials in the US in December

2011 for the treatment of gastrointestinal tumours. The Cancer

Immunotherapy group has recently been awarded £500k in grants from the UoN

with matched funding from Cancer Research UK, Pancreatic Cancer Research

fund and Lewis Trust to set up a Centre of Excellence in Therapeutic

Antibodies. The aim is to produce and license further anti-tumour

antibodies to the Pharmaceutical industry to promote rapid clinical trials

and to allow the centre to become self-financing.

As part of the research, Durrant also developed cancer vaccines. The lead

product, 105AD7 was produced in collaboration with Professor John

Scholefield (Professor of Surgery, UoN 1998-2013) and was shown to

stimulate T cell responses in over 300 colorectal cancer patients with no

associated toxicity (2,3). In collaboration with Professor Kathy

Pritchard-Jones (UCL) a similar trial was performed in osteosarcoma

patients. Two of the 28 patients were cured of their disease and survived

for at least 10 years post treatment (4).

Scancell have now shown that it is possible to replace the T cell

epitopes within 105AD7 with a range of different epitopes and stimulate

high avidity T cell responses targeting other cancers (5,6). This vaccine

worked as a protein but is more effective in DNA form. The vaccine is

superior to traditional DNA vaccines, peptide vaccines and peptide pulsed

dendritic cell vaccines, as it directly targets antigen-presenting cells

and cross presents the antibody via the high affinity Fc receptor, CD64

(5,6). This approach, termed "ImmunoBody®", has been patent

protected.

The lead product emerging from this research, SCIB1, is a DNA vaccine for

melanoma. In collaboration with Professor Poulam Patel (Professor of

Oncology, UoN, 2003-2013), SCIB1 successfully completed Phase I (2012),

and has just completed recruitment for Phase II, clinical trials. Phase I

results showed no toxicity and at the highest dose one of four advanced

melanoma patients showed tumour regression of most lesions, including

complete regression of lung lesions in one patient. Scancell is continuing

to develop a range of ImmunoBody® vaccines for treatment of

other cancers. They have recently developed a new vaccine platform based

upon modified self-peptides with the patent filed in August 2012.

References to the research

1. LG Durrant, SJ Harding, NH Green, LD Buckberry, and T

Parsons (2006). A new anti-cancer glycolipid monoclonal antibody, SC104,

which directly induces tumour cell death without immune effector cells.

Cancer Res. 66(11) 1-9. http://dx.doi.org/10.1158/0008-5472.CAN-05-3812

3. GJ Ullenhag, I Spendlove, NF Watson, AA Indar, M Dube, RA

Robins, C Maxwell-Armstrong, JH Scholefield, and LG Durrant.

A neoadjuvant/adjuvant randomized trial of colorectal cancer patients

vaccinated with an anti-idiotypic antibody, 105AD7, mimicking CD55 (2006).

Clin Cancer Res. 12: 7389-7396. http://dx.doi.org/10.1158/1078-0432.CCR-06-1003

4. K Pritchard-Jones, I Spendlove, C Wilton, J Whelan, S Weeden, I

Lewis, J Hale, C Douglas, C Pagonis, B Campbell, P Alvarez, G Halbert, and

LG Durrant. Immune responses to the 105AD7 human

anti-idiotypic vaccine after intensive chemotherapy, for osteosarcoma

(2005). Br J Cancer . 92: 1358-1365. http://dx.doi.org/10.1038/sj.bjc.6602500

5. VA Pudney, RL Metheringham, B Gunn, I Spendlove, JM Ramage and LG

Durrant (2010). DNA vaccination with T cell epitopes encoded

within antibody molecules induces high avidity CD8 T cells which are

capable of efficient anti-tumor activity. Eur J Immunol 40(3) 899-910.

http://dx.doi.org/10.1002/eji.200939857

6. VA Brentville, RL Metheringham, B Gunn and LG Durrant

(2012). High avidity CTL to tumor associated antigens can be selected into

the memory pool but they are exquisitely sensitive to functional

impairment. Plos one 7(7):e41112 http://dx.doi.org/10.1371/journal.pone.0041112

Grants underpinning this research and awarded to Professor Durrant:

• Cancer Research UK programme grant — £400K; 1993-1997

• Cancer Research UK funding for antibody development — £500K; 2008-2015

• Lewis Trust funding for anti-Lewis y mabs — £250K; 2008-2016

• Pancreatic Cancer Research Trust funding for anti-pancreatic mabs —

£250K; 2010-2014.

Patents:

• Specific binding members; patent awarded in Europe (EP1745077;2012),

Japan

(JP4944016;2012), US (US8343490;2013:US7915387;2011), Australia

(AU2005240837;2011: AU2011200487;2013), China (CN1961004;2012), India

(6191/DELNP/2006;2011), Korea (KR2007008511;2012), New Zealand

(550738;2011).

• A human anti-idiotypic antibody 105AD7; patent awarded in Europe

(EP0440689;1995), Japan (JP3095169) and USA (US6042827).

• Binding member which binds to both lewis-y and lewis-b haptens, and its

use for treating cancer. Patent awarded in Europe (EP1385547;2009),

Australia (AU2002307934;2007), Japan (JP4559030;2010), USA

(US7267821;2007: US7879983;2011; US8273349;2012).

• Humanised antibodies to the epidermal growth factor receptor. Patent

awarded in Europe (EP1278851; 2006), China (CN1239701), Korea

(KR100480985;2005).

• Polypeptides stimulating T cell responses; WO02058728

(A2). Patent awarded in Europe (2005), US (2012), Australia (2007).

• Denatured antigen DNA vaccine; PCT 08735583; awarded in Europe in 2013.

• DCIB68 DNA vaccine; PCT10152624.2; patent awarded in Europe in 2011.

• Anti-tumour responses against modified tumour antigens;

PCT/GB2013/052109.

Details of the impact

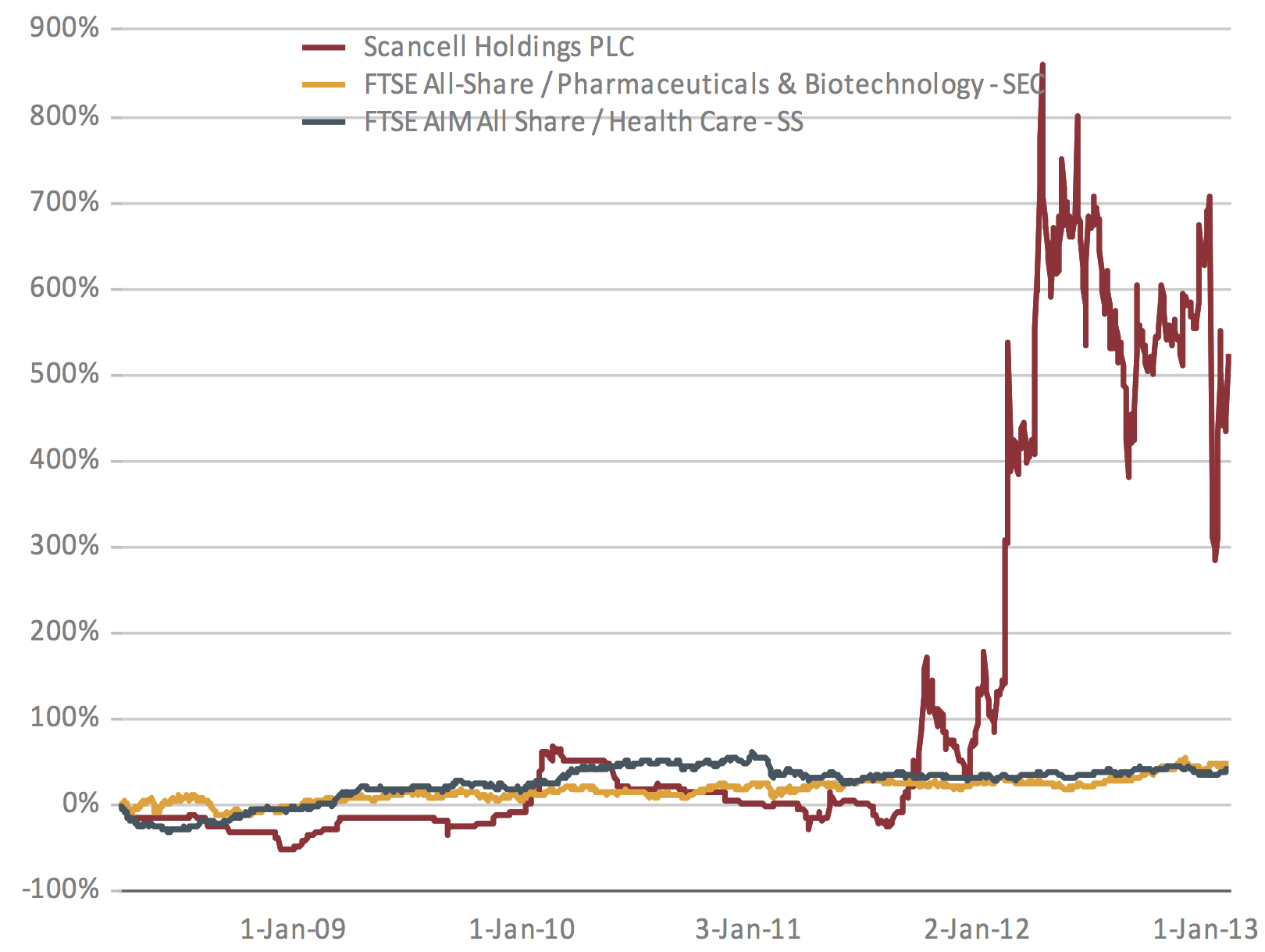

Scancell Holdings Plc (a) has legitimised an exciting new model for

Biotechnology investment; demonstrating that floating on the stock market

at an early stage can realise good returns for private investors. This

unlocks greater potential for the private sector to invest in a wide range

of research and development. In line with the Government's plan to promote

the Biotechnology Industry, this provided a good opportunity to translate

more novel products into the clinic and onto the market. Scancell out

performed shares in the biotechnology industry as indicated by the FTSE

All-share index for Pharmaceutical and Biotechnology and all shares in AIM

(see graph). Cancer immunotherapeutics, such as those developed by

Scancell, are predicted to bring in $35 billion in annual sales for the

Pharmaceutical industry (b) and, by 2018, 4 of the top 5 cancer products

are expected to be immunotherapies.

Figure showing the % increase in share price from Jan 2009

until Jan 2013.

Figure showing the % increase in share price from Jan 2009

until Jan 2013.

Scancell has generated licensing income of £6million from

US/Japanese/Korean companies from its patent portfolio (c). It filed

patents on the three most promising mabs, SC100, SC101 and SC104. SC100

was then licensed to a Korean company ISU. Scancell sold its cancer

killing mabs including SC101 and SC104 to the Australian biotechnology

company, Peptech Therapeutics (now part of Teva). The lead candidate

antibody, SC104 (CEP-37250/KHK2804), was humanised by Peptech and

defucosylated by Kyowa Hakko Kirin in Japan and both these companies are

co-developing it. It entered phase I clinical trials in the US in December

2011 (d). These international deals have all helped to increase the

profile of UK Biotechnology around the globe. Scancell continues to

develop its vaccine platforms and currently holds four patent families

protecting cancer vaccine platforms targeting solid tumours and infectious

diseases (e). It filed its initial protein vaccine platform in 2006 and

this was awarded in Europe in 2007 and in the US in 2012. In 2008, it

filed its DNA patent portfolio. The first patent on its lead vaccine

SCIB1, which is currently in clinical trial (f), was awarded in Europe in

2012. In 2012 it developed a novel platform on modified peptides and filed

a patent in August 2012.

Scancell financed its expansion with an innovative approach, which has

legitimised a new model for Biotechnology investment. After spinning out

and raising private equity funding (£4 million) it acquired a PLUS listing

in 2008 and an AIM listing on the London Stock exchange in 2010 (g). In

2012, in response to the successful clinical results for SCIB1, Scancell

holdings plc shares increased by the highest percentage on the London

stock exchange, generating significant press coverage for both the company

and the University. From its initial market capitalisation of £10m it

reached a value of £98 million which provided a tenfold return for

investors (h). As indicated in the PraxisUnico annual report 2013 (i),

Scancell is one of the few University start-up companies to provide not

only reward for early investors but also a vehicle for further investment

and profit.

As a result Scancell has clearly demonstrated the potential for private

sector investors in small scale Biotech to realise strong returns within

reasonable time scales. This provided a new successful model for

Biotechnology investments whereby individuals can invest at different

stages of a product's life history and still get value on their

investment. Additionally, as the companies mature, there remains a large

upside for new investors as the products are licensed/sold to the

pharmaceutical industry. In July 2013, Scancell raised a further £6.5

million and although the share price dipped it has come back strongly and

its market capitalisation has remained stable at around £80 million during

2013 (g).

Scancell has thus created significant value from modest investments of

£10.5 million. It has done this through innovative science, a novel

business model and by keeping overheads low. By listing on the stock

market it has released significant value for its initial investors. Along

the way Scancell has contributed to the local economy, employing 9-10

highly skilled people during the period 2008-2013 and supporting other UK

businesses through its outsourcing of manufacturing, development and

clinical work.

In line with the Government's plan to promote Biotechnology Industry,

Scancell's model provides an example of how to promote investment in this

sector.

Sources to corroborate the impact

(a) All financial and corporate governance details are corroborated by

accounts filed by Scancell holdings plc at companies house and on the

company website http://www.scancell.co.uk

(also available as a pdf on request).

(b) News article: http://www.cnbc.com/id/100757009

(PDF available on request.)

(c) The licensing deals and revenues are all publicised in press

releases, copies of which are found on the company website http://www.scancell.co.uk.

Examples (in pdf format) are available on request.

(d) Clinical trials of SC104/CEP-37250/KHK2804: http://clinicaltrials.gov/ct2/show/NCT01447732

(e) Patents. See:

http://worldwide.espacenet.com/searchResults?compact=false&ST=advanced&IN=Durrant&locale=en_EP&DB=EPODOC&PA=Scancell

(a pdf of patents is also available on request).

(f) Clinical trials of SCIB1: http://clinicaltrials.gov/ct2/show/NCT01138410?term=SCIB1&rank=1

(g) Its current share price and market capitalisation can be verified at

the London Stock exchange linked via the website: http://www.scancell.co.uk/Apps/Content/HTML/?id=133

(h) News articles: http://www.thisismoney.co.uk/money/investing/article-2254089/Stock-market-winners-losers-2012-Small-proved-beautiful-energy-firms-helped-shares-shine.html

http://www.thetimes.co.uk/tto/business/markets/article3644511.ece

(PDF available on request.)

(i) PraxisUnico Spinouts UK Survey: Annual Report 2013 (PDF available on

request).