UOA10-11: Risk On / Risk Off: from academic research to financial market staple

Submitting Institution

University of OxfordUnit of Assessment

Mathematical SciencesSummary Impact Type

EconomicResearch Subject Area(s)

Economics: Applied Economics, Econometrics

Commerce, Management, Tourism and Services: Banking, Finance and Investment

Summary of the impact

This case study charts the influence of the Risk On / Risk Off (RORO)

paradigm, developed in research at the University of Oxford in

collaboration with investment bank HSBC. Since 2008, RORO has had a

significant economic impact on HSBC as well as wider impact on the

thinking and actions of investors and other global market participants.

Having begun as a specialised research tool within HSBC's foreign exchange

team, the RORO methodology was publicised in the advice that HSBC supply

to a wide range of major fund managers, corporate institutions and central

banks. The research has led directly to a change in the way that asset

managers think about investment decisions, with consequent impact on the

investment and risk management strategies they undertake. RORO is

regularly featured in the financial press and is becoming increasingly

mainstream, with coverage in national and international media aimed at

retail investors.

Underpinning research

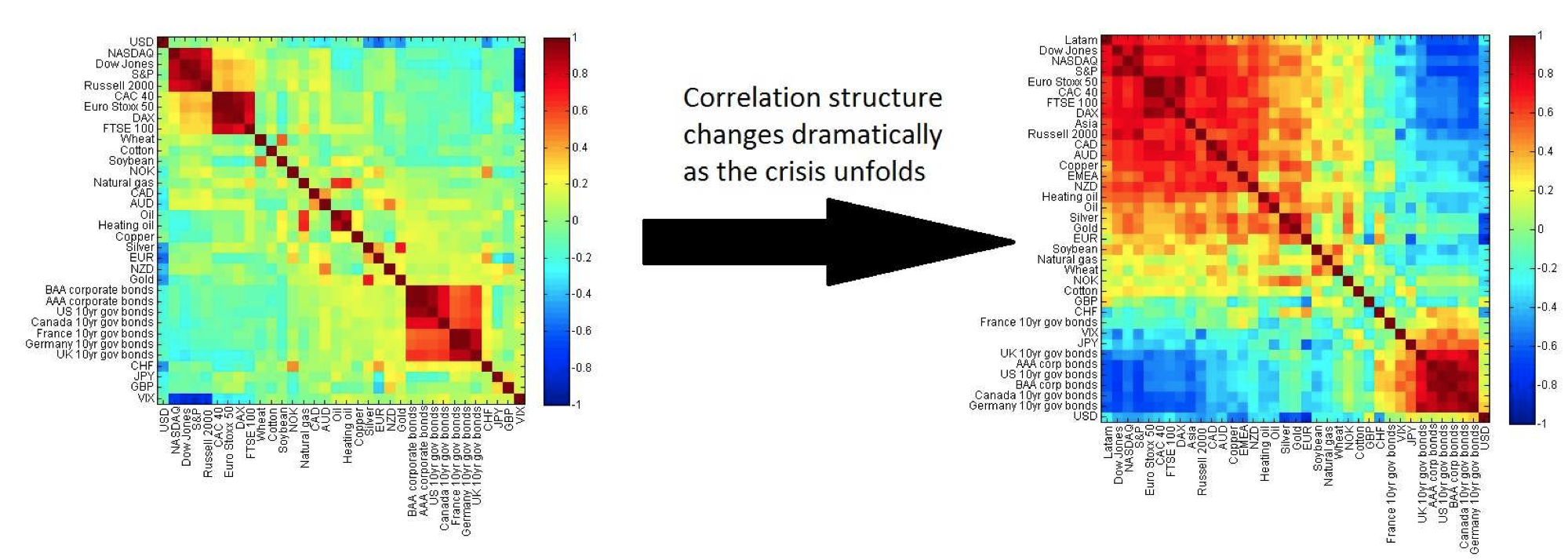

The collapse of Lehman Brothers in 2008 precipitated a dramatic and

enduring change in the correlation structure of global financial markets.

This has become widely known by investment professionals as the Risk

On/Risk Off (RORO) phenomenon — a term coined by the authors of the

research considered below, and now common market parlance.

Researchers in the University of Oxford started thinking about the

temporal evolution of multi-asset correlations and their relationship to

macro-economic and geo-political events in 2008. In [1] these were

characterised and measured using evolving correlation matrices, which were

constructed from a large dataset covering 98 major asset prices over 12

years from January 1999. The research compares the realised correlations

with those that would result from a random-matrix equivalent, revealing

that there is structure in the data that is not present in the Gaussian

model used in standard financial theory. This structure is investigated in

more detail via a Principal Component Analysis. A key result is that

before the collapse of Lehman Brothers in September 2008, the first

component is generally unremarkable and many assets are close to

uncorrelated (see the left-hand panel of the figure below, in which the

colour indicates the strength of correlation). Post-Lehman, a dominant

component emerges, the strength of which is tightly coupled to market

events, as illustrated in the right-hand panel of the figure below, in

which all bonds are closely correlated, as are all equities.

The research [1] provided a view of the markets which came to be known as

RORO. This is the direct manifestation of the Principal Component Analysis

in [1], and is backed up by the parallel studies [2,3] which use

techniques from network analysis to develop algorithms to detect large

clusters which may indicate the presence of changes of risk states. RORO

uses two states to characterise market conditions, and individual assets

are characterised as being either risky assets, or safe-havens. "Risk On"

periods see investors buy risky assets and employ traditional

correlation-based strategies, although even in these periods, correlation

levels are much higher than was typical before the financial crisis. Thus,

risky assets rise in value and safe-haven instruments fall. In "Risk Off"

periods these moves swing into reverse as investors all move into safe

havens, which all become highly correlated. RORO has profound consequences

for asset managers as well as for other market participants such as hedge

funds, corporate institutions and central banks.

A second significant outcome of the research, also described in [1], was

the development of PCA- based graphical and quantitative methods to

analyse the evolution of correlation structure, track the RORO phenomenon

and monitor its influence on particular assets.

The underpinning research was carried out at the University of Oxford

between 2008 and 2011 together with colleagues from HSBC. The key

researchers were Mason Porter (University Lecturer, 2007 to date) and Dr

Nick Jones (Research Fellow, 2008-2012).

References to the research

* [1] Fenn DJ, Porter MA, Williams S, McDonald M, Johnson NF & Jones

NS. Temporal evolution of financial-market correlations. Phys.

Rev. E 84, 026109, 2011. DOI 10.1103/PhysRevE.84.026109.

* [2] Fenn DJ, Porter MA, McDonald M, Williams S, Johnson NF, & Jones

NS. Dynamic Communities in Multichannel Data: An Application to the

Foreign Exchange Market During the 2007-2008 Credit Crisis, Chaos, 19,

033119, 2009. DOI 10.1063/1.3184538.

* [3] Fenn DJ, Porter MA, Mucha PJ, McDonald M, Williams S, Johnson, NF,

& Jones NS, Dynamical Clustering of Exchange Rates,

Quantitative Finance, 12, 1493-1520. 2012. DOI

10.1080/14697688.2012.668288.

The three asterisked outputs best indicate the quality of the

underpinning research. All these papers are in high quality

internationally refereed journals.

Details of the impact

The primary impact of the research described in Section 2 is economic,

and the beneficiaries are HSBC and other financial institutions. There is

secondary societal impact in the adoption of RORO as a standard term in

media coverage of financial markets. All impacts have occurred since 2008.

From research to impact

The HSBC Foreign Exchange Group were key partners in the development of

the underpinning research, three HSBC employees were coauthors, and HSBC

coined the phrase RORO. The underpinning research was taken up by the

Foreign Exchange Research Group at HSBC, the world's third largest bank by

market capitalisation. The bank has a major presence in global markets

with large trading operations in all significant asset classes. Trading is

undertaken on behalf of clients, including institutional and sovereign

fund managers, central banks, charities, and supra-national organisations.

HSBC Research actively engages with its client base, both enhancing the

clients' background understanding of markets and providing advice on

specific investment and trading strategies.

The Head of FX Quantitative Strategy at HSBC states [A] "The RORO

research was translated from the original PRE paper into two major HSBC

Global Research publications [Risk On-Risk Off: a paradigm is born

(2010) and Risk On-Risk Off: Fixing a broken investment process (2012)],

aimed at Market Practitioners". These publications explore the

far-reaching consequences of RORO for market participants, and describe

techniques explicitly devised to combat the phenomenon, with strategies to

aid market participants in incorporating this new view of the market into

their planning. HSBC also devised the HSBC RORO Index (illustrated below)

to quantify the RORO effect.

Nature and extent of the impact

Investors have traditionally relied on certain guiding principles, some

of which are consistent with standard finance theory such as the Capital

Asset Pricing Model (assets respond to their own economic fundamentals as

well as overall market conditions, risk reduction through diversification

is achievable across asset classes) and others which may not be (enhanced

returns can be generated though "active" strategies such as relative value

trades and stock picking). The RORO phenomenon means these principles are

much less useful than they once were. Furthermore, and crucially for

investors, it provides a replacement framework within which they can

construct new and effective asset allocation strategies.

Immediate impact for HSBC can be measured in terms of client take-up.

Research is distributed via a web-site, and by an emailed web-link,

enabling active downloads to be tracked. The Head of FX Quantitative

Strategy at HSBC writes [A]: "In 2012, HSBC published over [text

removed for publication] research reports. Scored by distinct

hits, the report "RORO: Fixing a Broken Investment Process" was ranked 3rd

globally. [...] It is a testament to the importance of RORO to

traditional practitioners as well as `quants' and points to RORO

becoming `mainstream and widely relevant. [...] HSBC also

distributes research in online video format and two videos were produced

... Of over [text removed for publication] video releases in 2012, these

two videos were ranked 2nd and 3rd most watched."

As a consequence of client demand, the PCA-based graphical and

quantitative tools, as developed by the University of Oxford and HSBC, are

now updated weekly by HSBC and provided to clients on a subscription

basis. The immediate commercial impact for HSBC is exemplified in the

letter from the Head of FX Quantitative Strategy at HSBC [A], which states

[text removed for publication]. Trading businesses are high volume,

low margin operations. A higher ongoing volume of client business is thus

extremely valuable. Numbers are too commercially sensitive to state, but

are significant enough that HSBC has now launched a dedicated Emerging

Market version of the PCA-based tools to further its Asian, Latin American

and Middle Eastern franchises.

Deeper impact is seen in requests for in-depth project work by HSBC from

top-tier clients. "We also conducted bespoke research for individual

clients, including central banks, corporates and investment managers

looking to adapt their businesses to the RORO phenomenon. The combined

AUM [assets under management] of these clients totalled hundreds

of billions of dollars" states the Head of FX Quantitative Strategy

at HSBC [A].

The research has directly benefited the wider investment management

community, with many substantial investors using the HSBC RORO index as a

key quantitative tool for making investment decisions. As an example of

typical usage, the website of Institutional Asset Manager, reporting a

presentation [B] by Peter Rigg, Global Head of HSBC Alternative Investment

Group and an early adopter of the use of RORO, states: "Quite simply,

until the RORO Index shows signs of falling, Rigg does not envisage a

transition from Scenario 1 [relatively pessimistic] to Scenario

2 [cautiously optimistic]"; it goes on to explain that his

investment strategy will be determined by this signal: "`We're

currently positioned for Scenario 1 but we can move quickly into

Scenario 2 when required', said Rigg". HSBC AIM is the largest

Alternative manager in the UK with $30 Bn AUM.

The Global Chief Investment Officer of [text removed for publication]

writes (to the University of Oxford) [C]: "Your published research in

this area has been instrumental for practitioners endeavouring to

measure and adapt to this once-in-a-generation shift in market

structure. I consider your work to be groundbreaking and it has had

significant impact within the asset management community and beyond".

A Director at [text removed for publication] writes [D]: "[RORO] helped

my team better understand our positioning during a difficult time in the

markets", listing areas where [text removed for publication] uses

it, including stress testing positioning (analysis of portfolio behaviour

under extreme scenarios) and assisting clients in total portfolio

construction. A Senior Portfolio Manager at [text removed for

publication], states [E]: "The hallmark of the RORO phenomenon

was a dramatic increase in cross-asset correlations: this had profound

consequences for the asset management community. [...] the

insight we derived from your research has had a direct impact on the

construction methodologies we adopted for our funds."

Use of the RORO framework has now extended well beyond HSBC and other

professional investment managers. After featuring in specialist

publications such as Risk Magazine ("Everyone is perplexed by these

risk-on or risk-off days, where it feels like you can actually see the

correlation increase" [F], para 2) and FX Week (headline: Risk-on,

risk-off markets boost demand for active currency management [G], RORO

began to feature regularly in the generalist financial press, often with

explicit reference to the HSBC research team. There have been many

appearances in the Financial Times and Wall Street Journal, for example "In

the scale of Risk On/Risk Off trading days, this looked usual" [H]

from the FT and the WSJ headline "Bernanke's 'Risk-On, Risk-Off' Monetary

Policy" [I]; they include columns, blogs, feature articles and inclusion

in a Private Wealth Management supplement. The Financial Times has

recently added RORO to the official list of tags it uses to index its

website FT.com, where a search for RORO gives more than 50 results [J].

The RORO paradigm has now moved on to become a staple of mainstream

journalism. For example, articles in the Times (headline: "Risk on, risk

off as stock market's RoRo goes into sharp reverse" [K]) and the New York

Times Business Day `Your Money' section ("Why are markets so highly

correlated? The answer may be found in "risk on, risk off," a bit of

jargon favored by financial traders and strategists." [L]) are aimed at

mainstream retail audiences, while [M] looks at the repercussions of RORO

for retirement planning and saving for children's education. Likewise,

mainstream retail investor websites use the terminology routinely; for

example, in an article entitle Rising star fund managers,

Investor's Chronicle simply quoted Jason Hollands from Bestinvest:. "A

false call on the risk on/risk off trade could turn a manager from hero

to zero overnight" [N].

Sources to corroborate the impact

[A] Letter from Head of FX Quantitative Strategy at HSBC, describing the

development, use and impact of RORO in HSBC. Copy held by University of

Oxford.

[B] http://www.institutionalassetmanager.co.uk/2012/02/07/161783/hsbc-alternative-

investments-limited-hail-remains-defensive-2012-while-risk-%E2%80%93-risk,

2012.

[C] Letter from CIO, [text removed for publication]. Copy held by

University of Oxford.

[D] Letter from Director at [text removed for publication] Copy

held by University of Oxford.

[E] Letter from Senior Portfolio Manager, [text removed for

publication]. Copy held by University of Oxford.

[F] http://search.proquest.com/docview/753944406/13D07A448C83210A5E5/6?accountid=130

42

[G] http://www.fxweek.com/fx-week/news/2188455/amundi-signs-mim-currency-account

[H] James Mackintosh, 'The Short View', The Financial Times, 5

January 2012,

http://www.ft.com/cms/s/0/40c5f0ea-37bd-11e1-a5e0-00144feabdc0.html#axzz2OIbGgj00

[I] http://online.wsj.com/article/SB10000872396390443524904577649793013124710.html?KEYWORDS=%22risk+on%22+%22risk+off%22 — note the attached tags. 2012.

[J] http://search.ft.com/search?ftsearchType=type_news&queryText=Roro

[K] http://www.thetimes.co.uk/tto/business/markets/article3424248.ece,

2013.

[L] http://www.nytimes.com/2012/01/29/your-money/how-long-can-the-stock-market-forget-about-the-pain.html?, 2012.

[M] http://www.nytimes.com/2011/04/03/your-money/03stra.html.,

2011.

[N]

http://www.investorschronicle.co.uk/2013/01/14/funds-and-etfs/the-big-theme/rising-star-fund-managers-262S1OKsmlBjoCcTo1CVcJ/article.html, 2013.

[C]-[E] confirm the reach and significance of the economic impact of RORO

among major fund managers. [F]-[N] corroborate the reach and significance

of the societal impact of RORO. The University of Oxford holds copies of

all webpages.